by Jane Pierrotti

Did Chicken Little know something we don’t?

Chicago is broke. Next year, Chicago has to cough up a state-mandated $600 million increase in contributions to police and fire pension funds. Crain's Chicago Business reports that Chicago’s tax and budget options could trigger the highest commercial property tax rate in the nation. And still leave the city millions short. That means even more tax increases or gutting services.

Illinois state legislators will have to restructure Chicago’s pension obligations. If they don’t, perilous decisions are ahead. It didn’t have to be this way.

Detroit is broke, but it didn’t have to be this way either. The Detroit Free Press has analyzed the city’s financial history back to the 1950s. They found that elected officials repeatedly failed – or refused – to make the tough economic and political choices that might have saved Detroit from financial ruin.

Instead of sucking it up and making the tough calls, Detroit has seen a huge exodus of residents, plummeting tax revenues, and skyrocketing home abandonment. In response, Detroit’s leaders have been in a borrowing binge, creating new taxes, failing to cut expenses, and handing out generous bonuses to workers and retirees.

Taxing higher and higher

Like Chicago, Detroit’s City leaders repeatedly tried to reverse sliding revenue through new taxes. Despite a new income tax in 1962, a new utility tax in 1971 and a new casino revenue tax in 1999 – just to name a few – Detroit’s revenue in today’s dollars has fallen 40% from 1962 to 2012. Higher taxes helped drive residents to the suburbs and drove away business. Today, Detroit still doesn’t take in as much tax revenue as it did just from property taxes in 1963.

Camden, NJ is broke. Stockton, CA is broke. Birmingham, AL is broke. Harrisburg, PA is broke. So is Oakland, CA, Providence, RI, and Riverdale, IL.

What do all of these cities have in common? Higher and higher taxes. More and more spending. Democrat rule. Some of these cities haven’t seen an elected Republican since the 1950’s. From Chicago to Camden to Stockton – these cities have operated on the myth that increased spending can be solved by raising taxes. They believed that hiking taxes brings more money into the treasury. Instead it brings less. It also kills cities.

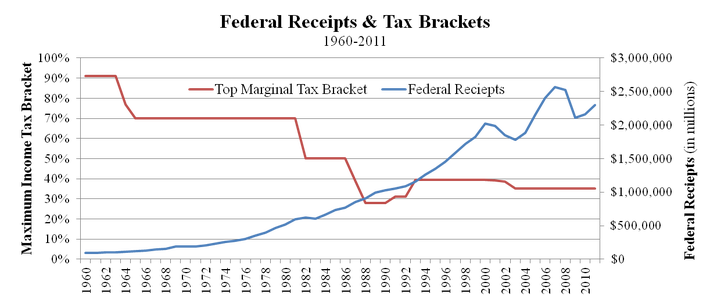

What brings more money into the treasury is lowering taxes. The chart below from Forbes Magazine proves that the lower the Federal tax rates, the higher the Federal receipts. JFK, Ronald Reagan, and George W. Bush all had it figured out.

Governor Scott Walker of Wisconsin has it figured out too. When he took office in 2010, the state was $3B in debt with an unemployment rate of 9.2%. He lowered taxes, cut spending, and faced down union bosses & outrageous retirement plans. Today, Wisconsin has a surplus of $1B which Walker is giving back to the taxpayers who earned it. Businesses are moving into the state. Unemployment has dropped to 6.1%.

High taxes are bad for cities

American Thinker in their December, 2013 issue said, “Low taxes encourage growth. Over the last 30 years, America's ten least-taxed metro areas experienced three times faster population growth, 2.7 times faster employment growth, and twice the increase in personal income as the ten most-taxed metro areas.”

In the latest Cato Journal, economist Dean Stansel observes:”If high-tax, low-growth metro areas like Detroit, Milwaukee, and Syracuse want to be like high-growth areas like Dallas, Tampa, and San Antonio, they should lower their onerous tax burden and control spending.” Will they? Nah. Ideology paralyzes. So does taxation.

More proof

The paralyzing effects of taxation are clear when you compare highly performing metro areas against poorly performing ones. At a combined 8% state and local tax rate, Bradenton/Sarasota/Venice, Florida grew population, employment, and personal income at rates 5 times faster than 12.6%-taxed Syracuse, New York.

- Six of the ten fastest-growing metropolitan areas are in states which levy no personal income taxes,

- All ten of the slowest-growing areas are in the highly taxed Northeast and Midwest.

- Regions scoring high on government assistance & taxation are heavily "progressive" (Democrat), while regions that fare best lean more libertarian (Republican).

There’s no denying it. High taxation kills cities by suffocating prosperity. Progressive zeal stifles economic growth. The progressive worldview darkens the human spirit and the human story. Why repeat it?

RSS Feed

RSS Feed